34+ Monthly 401k withdrawal calculator

Just like 401ks and other employer matching programs there are specific tax shields in place that make them both appealing. The benefits of most of these plans include a tax deduction on any contributions but the downside with all of these is the retirement withdrawals will be taxed as income.

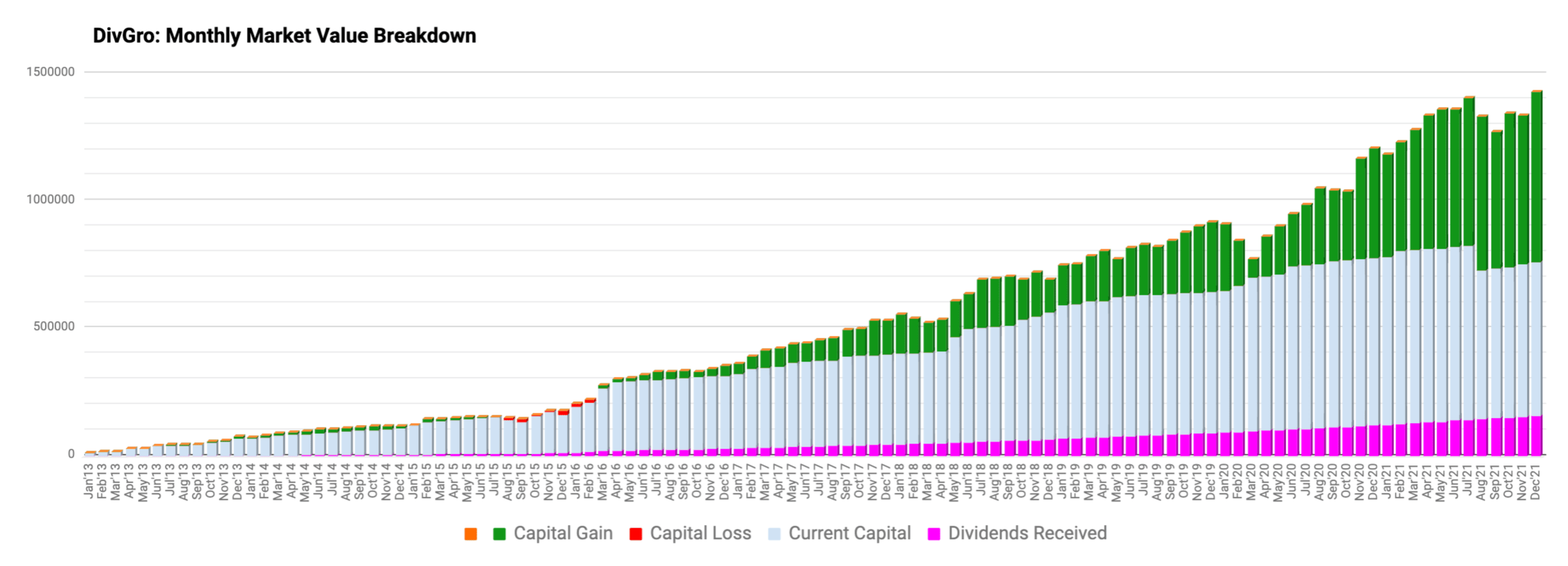

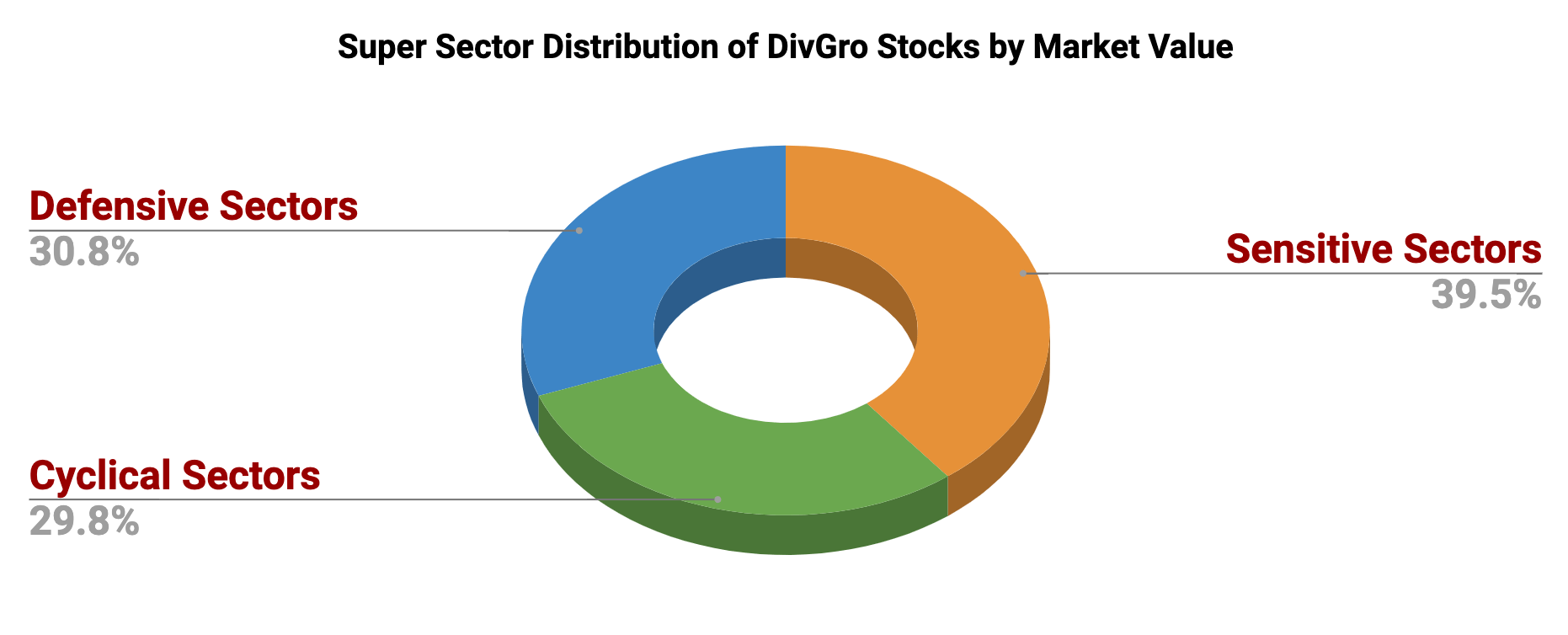

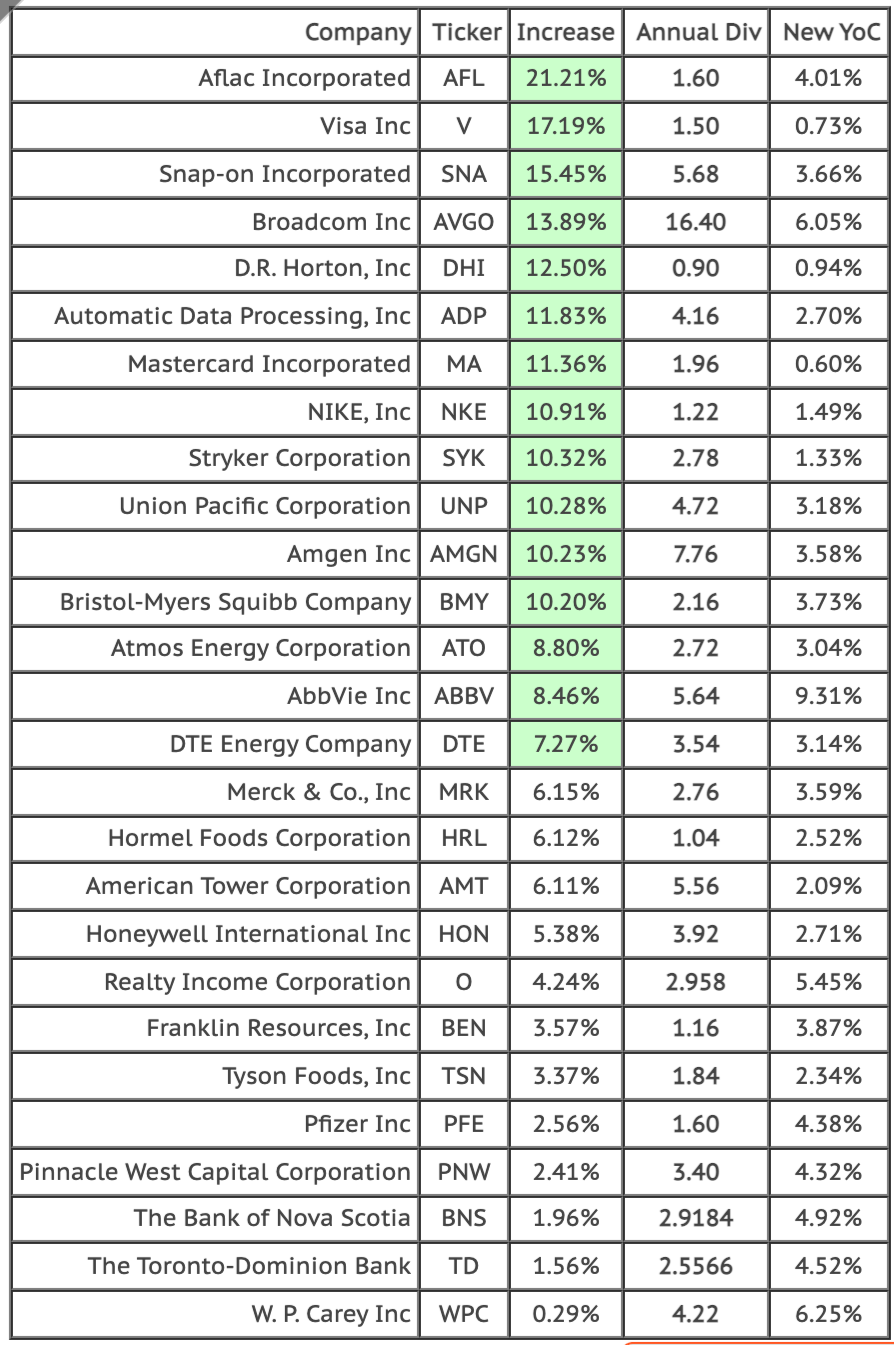

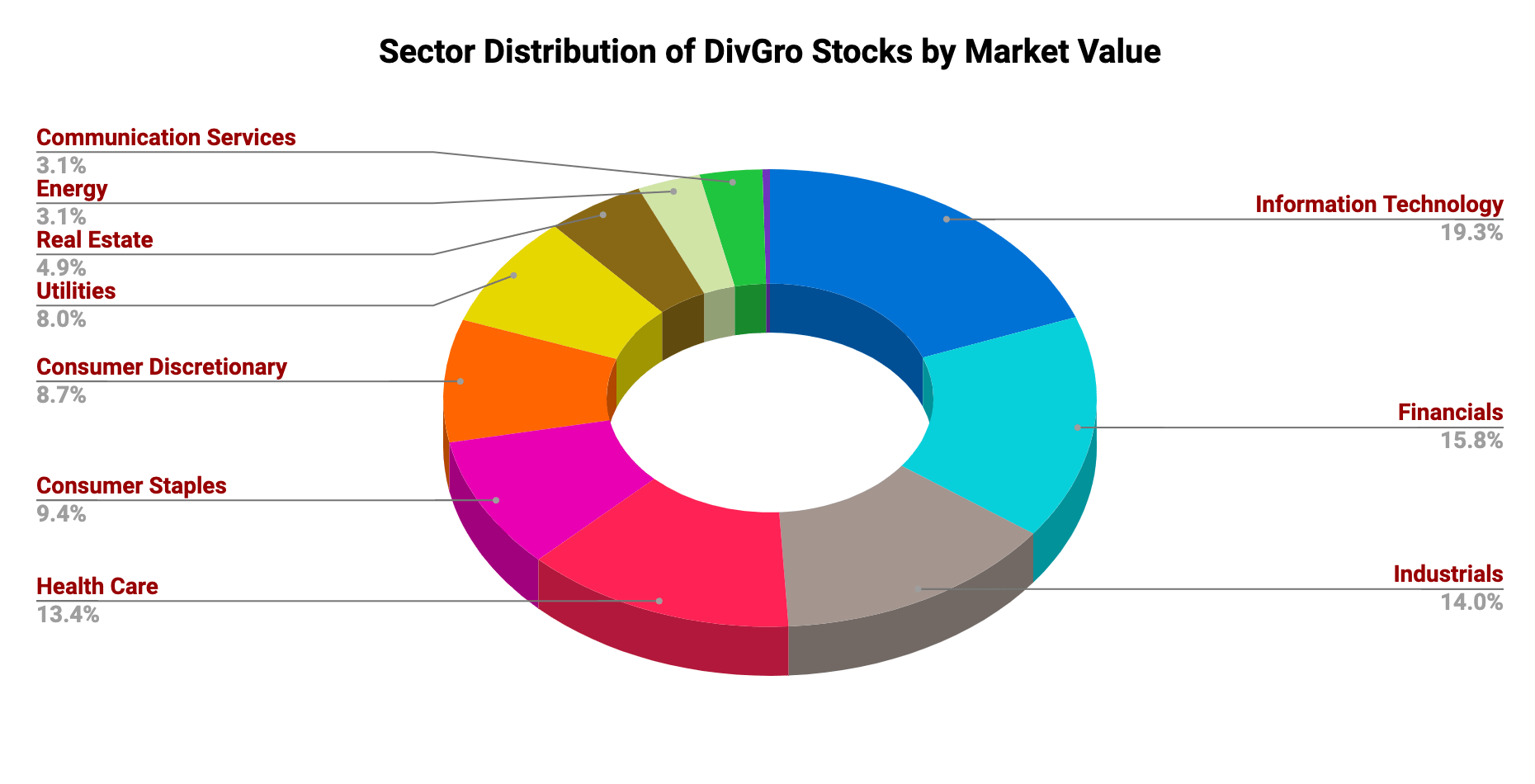

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

25Years until you retire age 40 to age 65 35Years of retirement.

. Retirement Withdrawal Calculator Terms and Definitions. Or withdrawals may be tax-free. 401k After-tax cost of debt Altman Z.

The benefits of most of these plans include a tax deduction on any contributions but the downside with all of these is the retirement withdrawals will be. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. 150070 will result in 87074 in interest earned at the end of Month 2.

Or of your investments. This amount doesnt include your pension or social security if theyve already started. When withdrawing your retirement savings from a 401 you can decide to take a lump-sum distribution take a periodic distribution buy an annuity or rollover the retirement savings into an IRA.

5Interest Rate compounded Annually 35Inflation Rate. The funds you will have saved when you reach your retirement age. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of retirement savings. This withdrawal rate calculator can be used to estimate monthly and annual income in retirement. After 800 in withdrawals you will be left with about 70 in income.

At the end of Month 1 your balance will therefore be 150000 70 150070. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit. Automated Investing With Tax-Smart Withdrawals.

Annual Interest Rate This is the annual rate of return you expect to earn on your. Usually once youâve attained 59 ½ you can start withdrawing money from your 401 without paying a 10 penalty tax for early withdrawals. IRA and Roth IRA.

Ad Use Our Early Withdrawal Calculator Tool To Understand The Potential Impacts. And from then on you should increase the amount to keep pace with inflation. This retirement calculator is for retirement planning.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. It has a savinginvesting cash flow and a withdrawal cash flow. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

Based on your effective tax assumption of 15 your annual after-tax income is. The age when you expect to retire. Check out 151 similar investment calculators.

Expected Retirement Age This is the age at which you plan to retire. Please visit our 401K Calculator for more information about 401ks. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b. Weve planned it such that your overall. A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term.

Retirement Calculator Part 2 the Retirement. Amount You Expected to Withdraw This is the budgeted amount you will need to support your personal needs during retirement. 270294750 or 27029475amount saved at time of retirement.

If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. 150000 will result in 87033 in interest earned at the end of Month 1. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit.

The calculator requires a total of seven inputs to determine these values. For example if you have 300000 dollars in your account you would withdraw 12000 dollars 1000 dollars monthly. Ready To Turn Your Savings Into Income.

Interest at 10 monthly withdrawals and compounding during 18 months. Expected Retirement Age This is the age at which you plan to retire. Possible Tax-Deduction on Contributions.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. We designed the present savings withdrawal calculator to find the answer to all the above questions. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Your life expectancy when you reach your retirement age. 10000 savings in hand and 300. The withdrawal amount translates to a monthly withdrawal amount of or a quarterly withdrawal amount of.

A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. Retirement Withdrawals will have State and Federal Income Taxes.

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

15 Best Investment Apps For Beginners In 2022 Updated Ranks

15 Best Investment Apps For Beginners In 2022 Updated Ranks

2

2

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

What Is Involved In Financial Planning Quora

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

2

Free 9 Employee Payroll Report Samples Active Balance History

15 Best Investment Apps For Beginners In 2022 Updated Ranks

15 Best Investment Apps For Beginners In 2022 Updated Ranks

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

2